The dry cleaning industry, like many others, was left in a state of uncertainty at the beginning of the pandemic. Nearly everyone I spoke to in the industry was asking the same two questions: What would happen to dry cleaning, and what were other dry cleaner owners seeing and doing in their business? People were searching for answers, but there were no clear solutions to either of these questions.

But it got me thinking about something I always had in the back of my mind: Why didn’t the dry cleaning industry have any good market research data available? Certainly, other businesses did, like restaurants, hotels, retail and so many more.

In our attempt to understand what the consumer was thinking during the pandemic, and to maybe help out in the industry in some small way, we decided to commission that first research study on consumers and dry cleaning in 2020. However, when we finished that study, we realized there were still many unanswered questions. So, with that we recently completed two separate research studies on dry cleaning consumers and dry cleaner owners.

To my knowledge, this is the most extensive study ever conducted for this industry, and our hope is that this data will provide some insight that might be beneficial to your business.

Consumer Insights

Before diving into the data, I’d like to note that the 1,000 consumers interviewed for this study had to identify themselves as high-use customers. To qualify, they had to meet the criteria of utilizing dry cleaning services weekly to multiple times a month (customers who make up the bulk of the average dry cleaner’s business).

How Satisfied are Customers with Their Dry Cleaner?

Let’s start with some good news—94% of these high-use customers are very satisfied with their current dry cleaner. When asked what would cause them to look for a new dry cleaner, participants responded (in order of significance) poor quality, poor customer service, slow service, and price. This not only shows that they really value quality above all else, but also that price is the least motivating factor.

What Will Customers Pay More for?

As mentioned above, the number one reason that customers would leave their current dry cleaner is related to quality. So, it makes sense that 70% of customers (including 84% of millennials) indicated they would be willing to pay more for even higher quality when it comes to their dry cleaning.

Putting quality aside for a minute, and looking at the speed of service, 66% of customers willing to wait two days or more to get their cleaning back say that if the turnaround time was faster, they’d be willing to bring in additional garments. This tells us that even if customers are willing to wait, they might be holding back on the number of items they bring in.

What Else do your Customers Want?

Today’s consumers don’t just want to place an order and be surprised by the arrival of their package. Let’s look at how a familiar favorite, Amazon, handles deliveries. When you order something from them, people can track their shipment—down to how many stops away the delivery is—and receive instant notification once it’s delivered with a picture as proof. We understand that the mammoth that is Amazon has logistical capabilities that most dry cleaners don’t, but the good news is that you can meet this consumer need with a simple text message. That’s right, 75% of consumers responded to the survey that they would like to be notified when their garments are ready, with all ages and demographics noting that they would prefer to be contacted by text rather than a call or email.

Dry Cleaner Owner Insights

Now that we’ve gained some insight into what dry cleaning customers are thinking, it’s time to look at the industry as a whole and see what we can learn about current challenges and opportunities from dry cleaner owners. This study was conducted with the help of 924 dry cleaner owners across the U.S.

Sales & Units

Slightly over half of dry cleaners reported that sales are still down from 2019. Regionally, the Northeast and South have seen the biggest hit to sales. Those dry cleaners whose sales are down are more likely to be even worse off from a unit perspective.

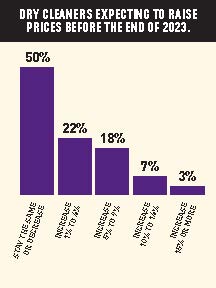

Garment Prices & Trends

Prices have risen across nearly every industry, and dry cleaners are no different—83% of dry cleaners have raised their prices since 2019, with the majority in the 10-19% range. Additionally, 50% responded that they plan to raise prices further by the end of the year. We wanted to benchmark the pricing on a national average for a few popular items, but it’s important to note that these can vary quite significantly from region to region.

- Laundered Shirt: $3.69

- Blouse: $7.56

- Pants: $7.65

- Sweater: $7.88

- 2-Piece Suit: $17.19

- Queen Size Comforter: $36.69

Surprisingly, on the consumer side of the study, 82% responded that they were aware of what they were paying for each garment. However, when we asked for those prices, their responses varied greatly.

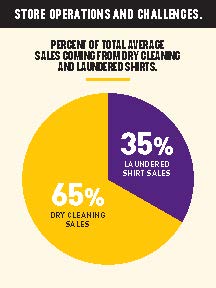

Store Operations & Challenges

From a dollar standpoint, most dry cleaners typically see 2/3 of sales come from dry cleaning and the other 1/3 from laundered shirts. From a production standpoint, the average dry cleaner is back to cleaning and pressing 4.8 days per week, which understandably had fallen during the pandemic.

The two biggest challenges facing dry cleaners today are recruitment and increasing sales. 47% of dry cleaners reported being understaffed, leaving many owners responsible for picking up the extra hours. Adding fuel to the fire, 89% of owners have indicated that, compared to last year, finding employees is about the same or more difficult.

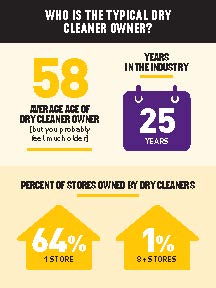

Who is the Typical Dry Cleaner Owner?

Today’s average dry cleaner is 58 years old with 25 years in the business—though that might feel like much longer for many. When we look at operators in the U.S., 84% operate two stores or less, with the vast majority (64%) being single-store operators and only a select few (literally the 1%) having eight stores or more. Additionally, the typical dry cleaner owner works incredibly hard, with over 77% working over 40 hours per week.

Growing your Dry Cleaner Business

At the end of the day, that’s what this study is about—understanding what the dry cleaning consumer wants and what others in the industry are doing to help you improve and grow your business.

Pick-up and delivery have always been a big part of many dry cleaner businesses, but during COVID, we saw a definite uptick in that service since many stayed home. Now, 52% of dry cleaners offer pick-up and delivery (71% at no extra charge), making up 24% of sales on average. For those who don’t currently provide these services, this could be a great way to increase business. However, our study also uncovered many other ways you can increase your business, with many dry cleaners adding services outside of their core dry cleaner business to generate additional revenue.

Here are the top three additional services by popularity and revenue generation:

- Alterations – 15% of total sales.

- Wash & Fold – 11% of total sales.

- Fire Restoration & Cleaning – 10% of total sales.

When it comes to investing in marketing, 54% of dry cleaner owners do not believe in spending money in this area. Those that do find the greatest return with Google Ad Words, email marketing, and text marketing.

What does the Future of Dry Cleaning look like?

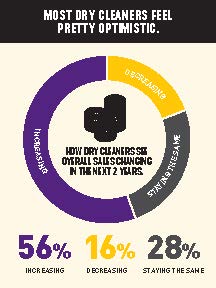

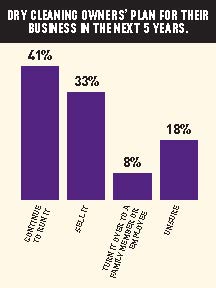

Overall, most dry cleaner owners indicated that they are pretty optimistic about the business moving forward. Things are looking up with 56% saying that they see business getting better and sales increasing. We are in for a change though, with the average age of a dry cleaner at 58 years old, 41% of dry cleaner ownership is expected to change hands over the next five years.

Despite the expected turnover, 57% of dry cleaners still see themselves making some type of capital investment in their business within the next three years, with dry cleaning and pressing equipment being number one, followed by wet cleaning machines and, lastly, software systems. This is a good indication that while they might be letting go of the reigns soon, they are confident that the business will only continue to get better and that the investments are worth it.

An enduring issue for the dry cleaning industry in the last few years has been the surge in remote workers. Luckily this seems to be turning around, with more and more companies calling their workers back into the office. According to a February 2023 study conducted by Pew Research, 35% of those who can work remotely still are, down from 43% in January 2022, but still a far cry from the 7% of remote workers pre-pandemic, meaning there’s still potential for a lot of growth in the industry going forward.

In summary, I’m very optimistic about the future of the dry cleaning industry. Consumer satisfaction sits at 94%, and as we’ve all seen in the headlines, more and more companies are calling workers back into the office in some capacity, which is only good for our business. If you would like to view either of the studies further, you can access them on the Cleaner’s Supply website.